Did you know that taxes are actually payments made to the government to provide public goods and services for the benefit of the community as a whole? It’s true! And while it may not be the most exciting thing to talk about, it’s important to know that both individuals and corporations are required to pay taxes in the United States.

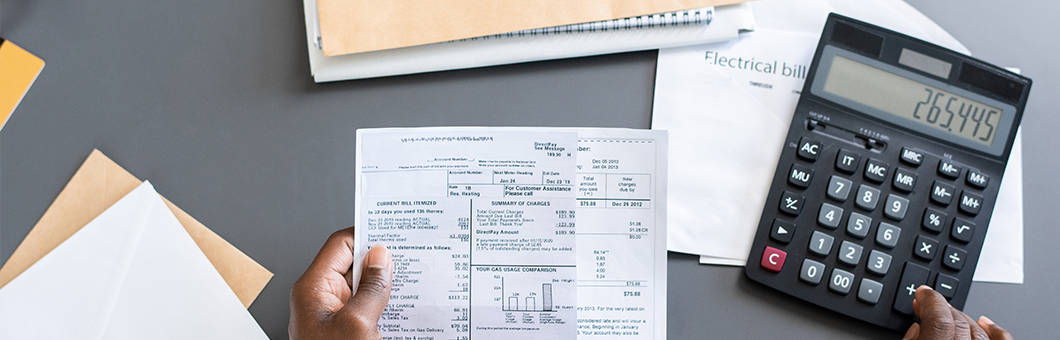

Taxes can be imposed by federal, state, and local governments. The income tax process actually begins on your first day of work, when you fill out a W-4 form.

When you fill out your tax form, you’ll see a worksheet that helps you figure out some basic information like whether you’re married or have dependents. This will help you determine how many allowances to claim.

Based on the number of allowances you claim, your employer will withhold a certain amount of money from each of your paychecks for income taxes. If you have a larger-than-normal tax bill to cover, you can ask for additional funds to be withheld from each check. It’s important to remember that income taxes are collected throughout the year, not just on April 15.

Filing your tax return is like basically “settling up” with Uncle Sam. If you didn’t withhold enough tax from your paychecks during the year, you might have to pay the balance, but if you overpaid, you’ll get a refund. It’s always a good idea to keep track of your taxes throughout the year to avoid any surprises coming in tax season.

Do you even need to file a tax return?

- The IRS only requires tax returns from people making the minimum amount of money for their filing status! Learn more

- If you work for yourself, do you have to pay income taxes throughout the year?

- Generally speaking, yes. As an independent contractor or sole proprietor of a small business, it’s important to make estimated tax payments every quarter. Check out TaxACT Checklist

TaxAct offers several different Do-It-Yourself filing options. You may qualify for free simple tax filing or select our Deluxe, Premier, or Self-Employed e-filing products. Visit here to stay up to date on filing “FYI”. 📚 AAA x TaxAct

About TaxAct

TaxAct® tax filing software empowers people to navigate the complexities of taxes with ease and accuracy at a fair price. TaxAct offers a comprehensive suite of online, download, and mobile solutions to make DIY tax filing fast, easy, and affordable. Backed by its long-standing accuracy and maximum refund guarantees*, TaxAct empowers filers to confidently complete their returns, for less. TaxAct will guide you through your filings and help you navigate state and federal returns. TaxAct offers easy to understand bits of information that help improve your tax outcomes and financial wellness. Get the guidance and support you deserve with your taxes, from TaxAct.